Home Affordability Calculator Know Price of Home That You Can Afford

Table Of Content

- How does a home affordability calculator help me?

- Many baby boomers own homes that are too big. Can they be enticed to sell them?

- What are the different types of home loans?

- Oxnard-Thousand Oaks-Ventura, California Metro Area

- What can be offered as collateral for a home loan?

- Other Factors That Determine How Much Home You Can Afford

On the flip side, if you have a price in mind, you can use a mortgage calculator to see how much cash you’ll need for a down payment and closing costs. However, just because you’re approved for a certain amount doesn’t mean you should buy a house with that home price. Instead, you’ll want to take a close look at your financial health, including your household income and monthly expenses, and make sure to set a firm budget once you begin your home search. Lenders care about your debt-to-income ratio because research shows that people with higher DTI ratios are less likely to keep up with their loan payments.

How does a home affordability calculator help me?

Most home loans require a 20% down payment, but Federal Housing Administration (FHA) loans only require a minimum of 3.5%. This type of loan opens the door for many potential homeowners that do not have the savings for a substantial down payment. However, this loan typically requires private mortgage insurance (PMI) which should be added into your monthly expenditures.

Many baby boomers own homes that are too big. Can they be enticed to sell them?

The calculator also allows the user to select from debt-to-income ratios between 10% to 50% in increments of 5%. If coupled with down payments less than 20%, 0.5% of PMI insurance will automatically be added to monthly housing costs because they are assumed to be calculations for conventional loans. There are no options above 50% because that is the point at which DTI exceeds risk thresholds for nearly all mortgage lenders. Your income plays a crucial role in determining how much house you can afford.

What are the different types of home loans?

Your emergency money can go toward paying your mortgage, if need be, and setting it aside can give you a little more peace of mind when determining how much you can realistically afford to pay for a house. When you apply for a mortgage, your lender ideally will want to see a 2-year work history before they grant approval. If you choose to take the largest loan you qualify for, will you be able to make those higher monthly payments during a period of unemployment? To find your debt-to-income ratio, first add together all of your monthly debt payments. For example, if you pay $200 each month on a student loan, $400 on a personal loan and $500 on an auto loan, your total debt payments are $200 + $400 + $500, which equals $1,100. Explore mortgage options to fit your purchasing scenario and save money.

In addition, take a look at the best places to get a mortgage in the U.S. You can also check out current mortgage rates in your area for an idea of what the market looks like. Even though Martin can technically afford House #2 and Teresa can technically afford House #3, both of them may decide not to. If Martin waits another year to buy, he can use some of his high income to save for a larger down payment. Teresa may want to find a slightly cheaper home so she’s not right at that maximum of paying 36% of her pre-tax income toward debt. Amy Fontinelle is a freelance writer, researcher and editor who brings a journalistic approach to personal finance content.

What can be offered as collateral for a home loan?

Your reserve could cover your mortgage payments - plus insurance and property tax - if you or your partner are laid off from a job. It gives you wiggle room in case of an emergency, which is always helpful. Homeownership comes with unexpected events and costs (roof repair, basement flooding, you name it!), so keeping some cash on hand will help keep you out of trouble. If you’re getting a conventional loan with less than 20% down and will have to pay private mortgage insurance (PMI), try to minimize this expense.

Other Factors That Determine How Much Home You Can Afford

Ultimately, having enough income is crucial for comfortably affording a home without financial strain. Lenders evaluate income to ensure mortgage payments are manageable and do not exceed a certain percentage of your monthly income. Just enter your location, yearly income, monthly debts and how much money you have for a down payment and closing costs. The calculator will take this information and tell you how big of a loan you can safely take on. Debt-to-income ratio, or DTI, is a measure that helps lenders estimate how easily you can repay your debts. When a person has a low debt-to-income ratio, it means that their debt payments make up a small portion of their gross monthly income.

How Much Should I Have Saved When Buying a Home?

The city's political landscape is predominantly Democratic, reflecting its diverse populace. Life in Los Angeles is full of opportunities to explore cultures, cuisines, and outdoor activities, but new residents should be prepared for higher living costs and traffic. Understanding and embracing the unique aspects of Los Angeles can make living in the city a truly rewarding experience.

How do current mortgage rates impact affordability?

Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Rates, program terms and conditions are subject to change without notice. Whether you will be using your property to live in, use on the side, or as an investment. While your lender is willing to loan you a substantial amount of money, that doesn’t mean you have to borrow the entire amount if it would put you under significant financial strain. Next up are several factors that can help you figure out the right price range before you hit the pavement looking for a new home.

The calculator divides that total by 12 months to adjust your monthly mortgage payment. Average annual premiums usually cost less than 1% of the home price and protect your liability as the property owner and insure against hazards, loss, etc. Private Mortgage Insurance (PMI) is calculated based on your credit score and amount of down payment. If your loan amount is greater than 80% of the home purchase price, lenders require insurance on their investment. To be approved for a VA loan, the back-end ratio of the applicant needs to be better than 41%.

How rising costs affect home affordability - LBM Journal

How rising costs affect home affordability.

Posted: Mon, 29 Apr 2024 15:05:36 GMT [source]

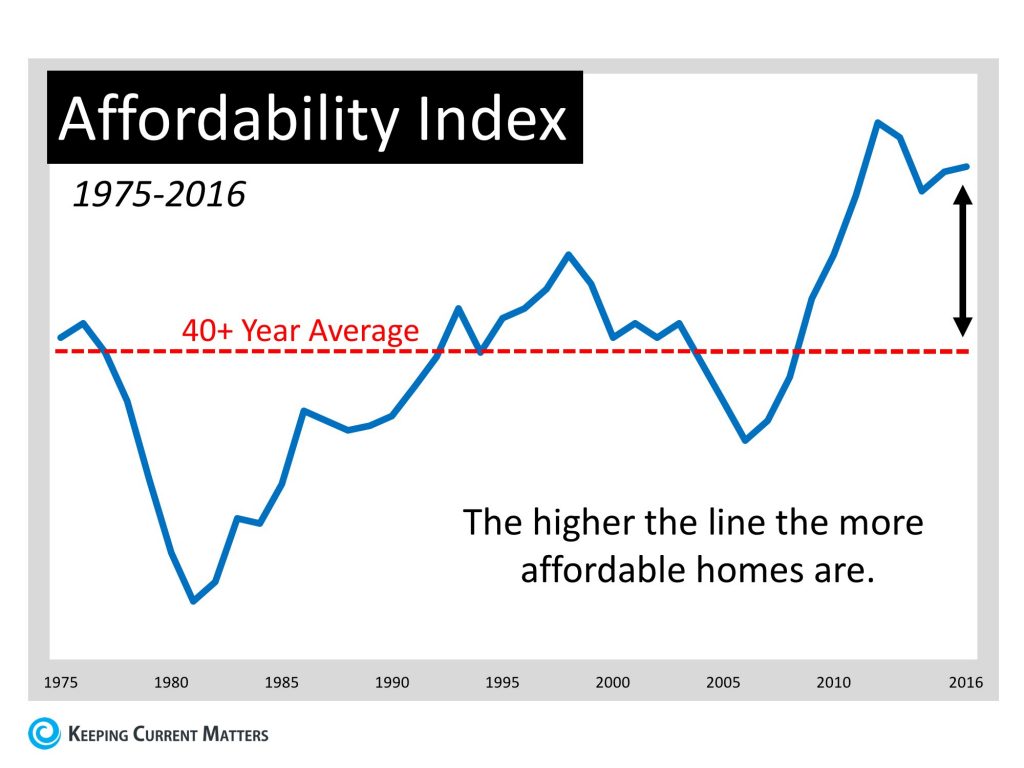

For example, affordability peaked in late 2012 as mortgage rates plummeted in the years after the US Great Recession, then dropped again when rates began to climb back up in 2013 (1). In March, a typical American household couldn’t afford all of a new mortgage payment, according to the latest data made available by Goldman Sachs. Their projections show that the United States won’t return to a point where the typical American can cover all of a new mortgage payment until 2025 or later. When affordability falls below this line, it means that the typical American household can cover just a portion of a new monthly payment. This line is the benchmark for whether a typical US household has enough money to cover the mortgage payment when buying a home.

You should first determine how a new mortgage would fit into your budget. So, take a close (and honest!) look at your current income and expenses. Then, if needed, brainstorm ways to earn more money or reduce your spending.

Child care costs have been growing rapidly; wages for child care workers remain low. Child care prices rose 210 percent—nearly three times as fast as the overall price index (74 percent)—from 1990 to 2019. While child care worker pay has seen recent increases, the median pay for a child care worker in 2022 was still under $30,000 per year. Persistently low wage prospects make attracting and retaining workers difficult, and issues with recruitment and retention can limit the supply of high-quality care, as discussed above.

The APR is calculated according to federal requirements, and is required by law to be included in all mortgage loan estimates. This allows you to better compare different types of mortgages from different lenders, to see which is the right one for you. To afford the average home in the Honolulu Metro Area, a household would need to save a total of $138,193.

Comments

Post a Comment